The Perks of Setting Up a Financial Offshore Corporation for Business Growth

The Perks of Setting Up a Financial Offshore Corporation for Business Growth

Blog Article

Comprehending the Relevance of Financial Offshore Accounts for Organization Development

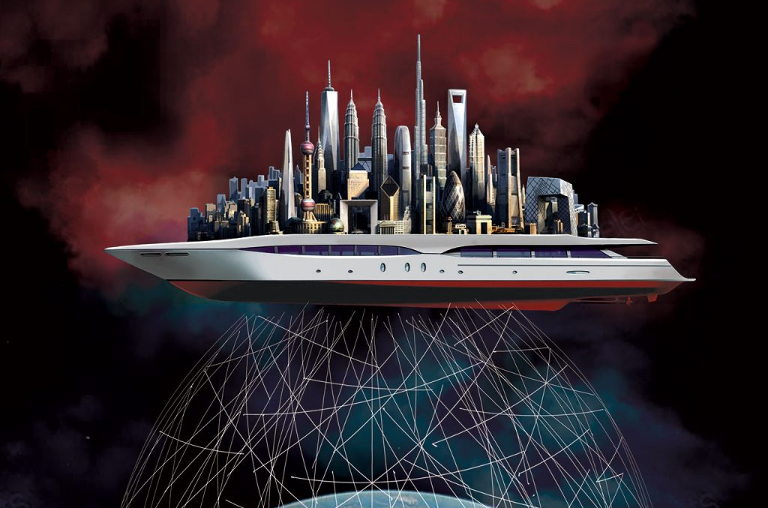

In the vibrant world of global commerce, financial overseas accounts stand as pivotal tools for business development, offering not just better currency adaptability however also possible reductions in deal prices. These accounts assist in access to diverse markets, enabling companies to leverage much better interest rates and tax performances. The calculated execution of such accounts needs a nuanced understanding of legal frameworks to make sure conformity and optimize benefits. This complexity invites more expedition into how organizations can effectively harness the advantages of overseas banking to drive their expansion efforts.

Trick Advantages of Offshore Financial Accounts for Organizations

While numerous companies seek affordable advantages, making use of offshore economic accounts can offer significant advantages. These accounts contribute in assisting in global profession by enabling business to manage numerous currencies extra effectively. When dealing with international exchanges, this capability not only improves transactions yet can also reduce the deal costs that stack up. In addition, offshore accounts usually provide far better interest prices compared to residential financial institutions, enhancing the capacity for revenues on still funds.

In addition, geographical diversity fundamental in overseas financial can act as a danger management tool. The privacy supplied by some offshore territories is an important element for businesses that focus on privacy, particularly when dealing with sensitive deals or exploring brand-new ventures.

Lawful Factors To Consider and Conformity in Offshore Banking

Although overseas monetary accounts provide countless benefits for organizations, it is critical to comprehend the lawful frameworks and compliance requirements that regulate their usage. Each jurisdiction has its very own collection of legislations and policies that can considerably influence the efficiency and legitimacy of offshore banking activities. financial offshore. Businesses need to guarantee they are not only adhering to the regulations of the nation in which the overseas account is located however additionally with international monetary laws and the regulations of their home country

Non-compliance can result in serious lawful consequences, including penalties and criminal fees. It is vital for businesses to engage with legal professionals that concentrate on international finance and tax legislation to browse these complex legal landscapes successfully. This advice aids make sure that their overseas financial tasks are performed legitimately and morally, straightening with both nationwide and international standards, thus safeguarding the business's credibility and monetary health and wellness.

Methods for Integrating Offshore Accounts Into Company Workflow

Integrating offshore accounts into company operations requires careful preparation and strategic implementation. Companies need to initially establish a clear goal for using such accounts, whether for resources preservation, tax optimization, or worldwide growth. It is important to pick the best jurisdiction, which not this contact form only straightens with the organization goals but additionally provides economic and political stability. Lawful advice ought to be included from the beginning to navigate the intricate regulative frameworks and make certain conformity with both home and foreign tax laws.

Businesses must integrate their overseas accounts into their overall monetary systems with transparency to maintain trust fund among stakeholders (financial offshore). This entails setting up robust accountancy methods to report the flow and track of funds precisely. Normal audits and evaluations need to be carried out to mitigate any type of threats connected with overseas banking, such as scams or reputational damages. By methodically carrying out these methods, companies can effectively make use of overseas accounts to sustain their growth campaigns while adhering to lawful and honest standards.

Verdict

In Go Here verdict, offshore economic accounts are important assets for organizations aiming to expand globally. Integrating them into company operations strategically can dramatically enhance money circulation and straighten with broader organization growth goals.

In the dynamic globe of global commerce, economic overseas accounts stand as pivotal tools for company growth, offering not only better money adaptability yet likewise potential reductions in deal expenses.While lots of services seek competitive benefits, the usage of offshore financial accounts can supply considerable advantages.Although offshore financial accounts provide various advantages for organizations, it is critical to understand the legal structures and conformity demands that control their use. Companies have to ensure they are not only conforming with the legislations of Read Full Article the country in which the overseas account is located however likewise with worldwide financial regulations and the laws of their home country.

Report this page